Data Whale’s R15 Ocean Market Infrastructure & v4 Data Offering

Proposal Application Details

![]() Ethereum Address - realdatawhale.eth

Ethereum Address - realdatawhale.eth

![]() Web3 Data Economy YouTube Channel

Web3 Data Economy YouTube Channel

![]() info@datawhale.ai

info@datawhale.ai

![]() Country of Residence - United Arab Emirates

Country of Residence - United Arab Emirates

![]() Our Round 15 Pledge: US$ 9,865

Our Round 15 Pledge: US$ 9,865

![]() Grant Reason

Grant Reason

- Establish a preliminary analysis of Ocean Market v4 and estimate the required changes for the ALGA Datatoken wallet.

- Launch our first IDO on the Ocean Market v4.

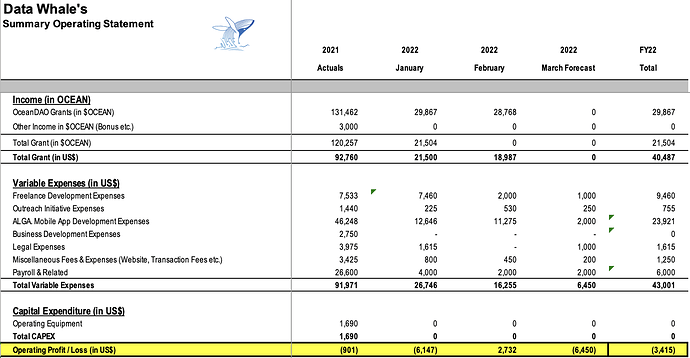

- Cover incurred expenses that were above grants (3415 US$).

- Scale Ocean Market Adoption with more marketing, outreach and tools.

Proposal Summary

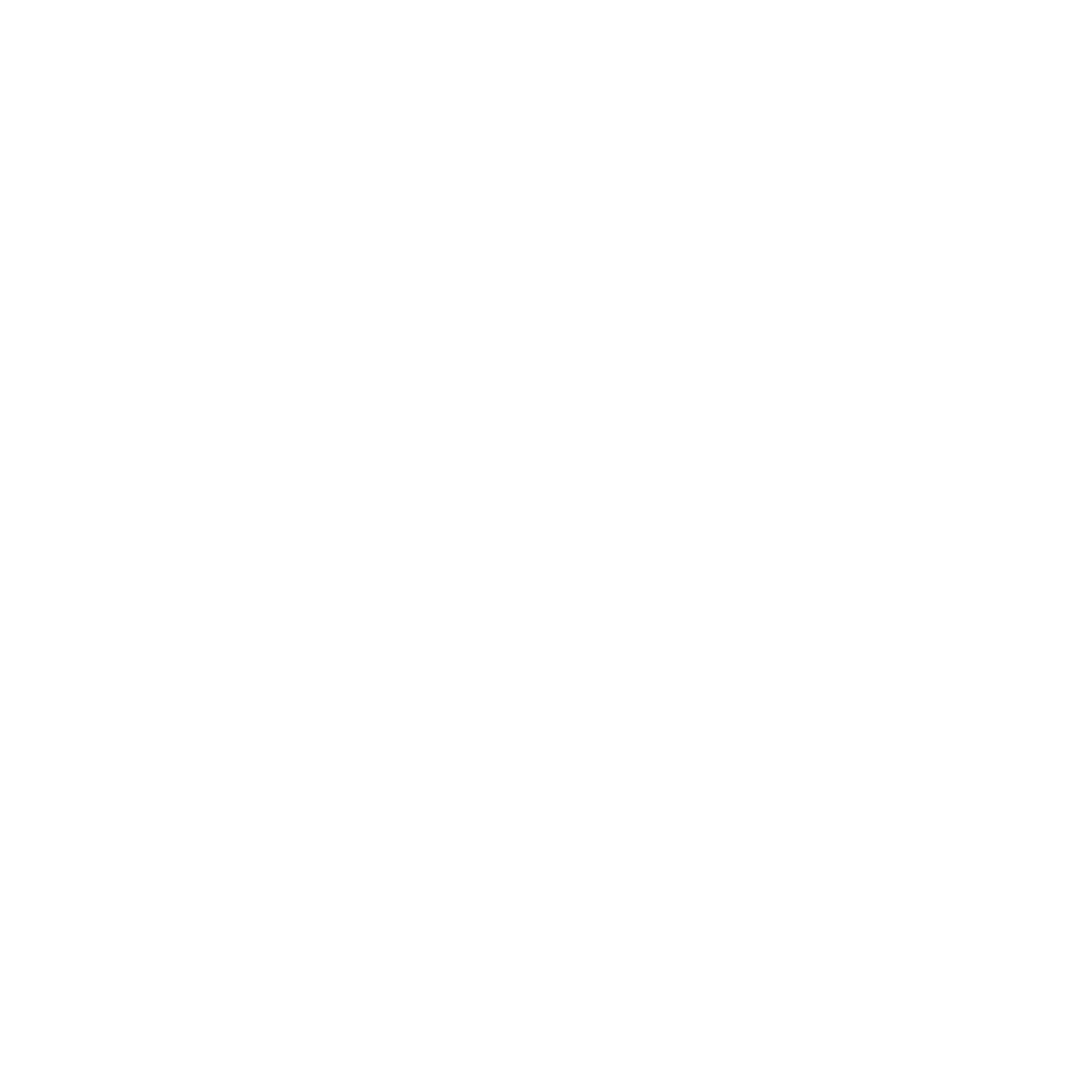

In 2022, our focus is to support Ocean Protocol’s objectives to encourage the “Year of Adoption”. We have RELEASED the ALGA Datatoken wallet on the Apple App Store and Google Playstore. We have further refined our Website with updated terms such as DataFi and Data NFTs, as well as Ocean Market Tutorials and the OCEAN MEME Library. Visit our new WEBSITE. Later in 2022, we will launch Datatoken.market and DataNFT.market.

Round 15 Deliverables

ALGA

[ ] Establish a preliminary analysis of Ocean Market v4 to estimate required changes for the ALGA wallet.

DATAWHALE.AI: Ocean Market Tutorials & MORE

[ ] To continue refining the Data Whale Website to become a one-stop-solution for all tools that the Ocean Protocol ecosystem offers.

Launch v4 IDO:

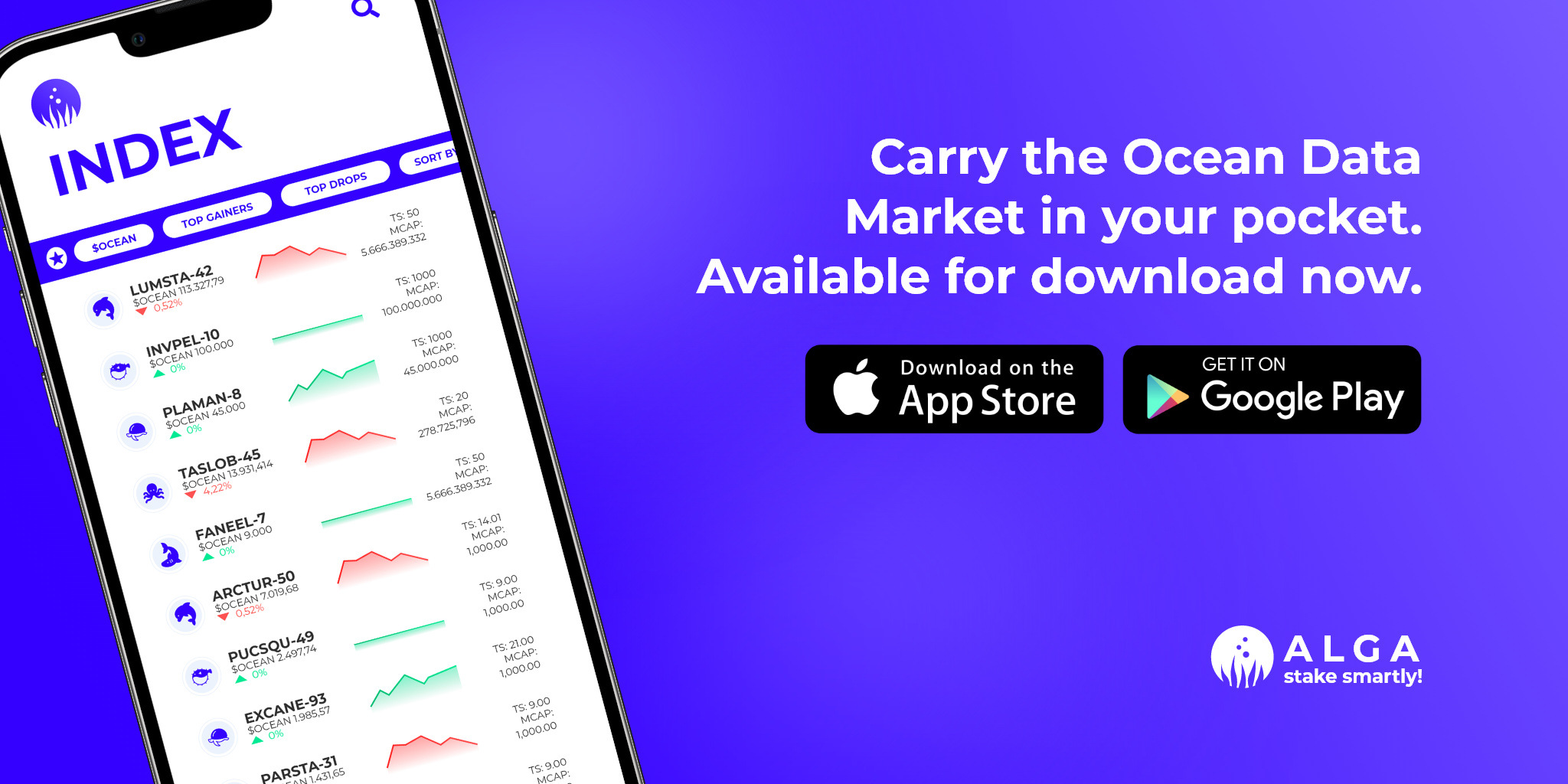

[ ] To launch the Data Whale Telegram Crypto Dataset on Ocean Market V4 and establish a legal framework under our registered entity Data Whale Ltd. for Initial Data Offerings that can be reviewed by other publishers.

Ocean Market Outreach:

[ ] To continue generic outreach initiatives on Twitter, YouTube and our Blog.

Data Whale Roadmap

In 2022, we will scale Ocean Market infrastructure and add more tools that make navigating the Web3 Data Economy as intuitive as possible.

Our Ocean Protocol Data Market Tools:

DATAWHALE.AI - a single source of information, making the Web3 Data Economy understandable for every target audience.

- Continue collaborating with the community to scale Ocean Outreach (OCEAN BOUNTIES and OCEAN AIRDROPS)

- Create partnerships with other projects to provide a resourceful overview for the Web3 Data Economy.

ALGA DATATOKEN WALLET - the first mobile Datatoken wallet to release 02/2022.

- Introduce Ocean Market V4 compatibility

- Introduce compatibility with Polygon and Binance Smart Chain

- Introduce Data NFT section (once launched)

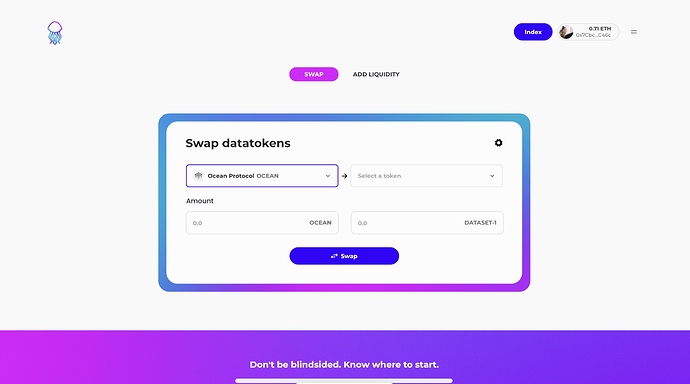

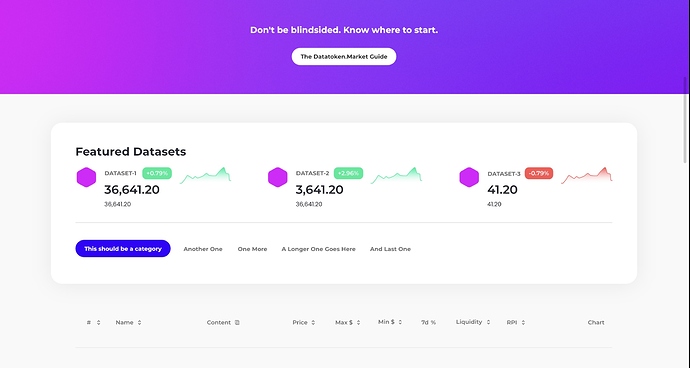

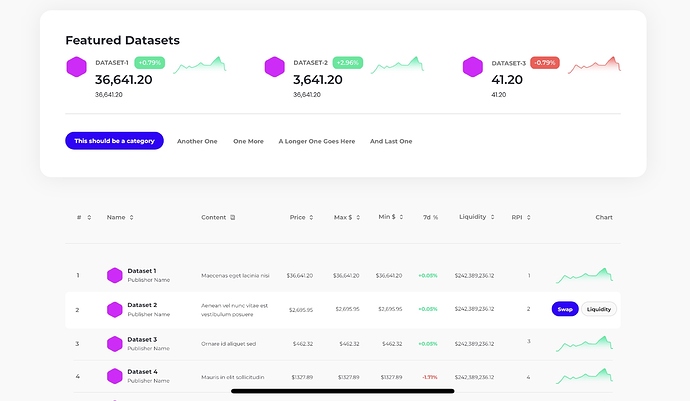

DATATOKEN.MARKET - a Web3 Website that offers an intuitive Ocean Data Market interface, where DataFi participants can research, navigate, stake and swap on the Top 50 Datatoken liquidity pools.

- Cost-effectively replicate ALGA’s backend to Web3 website by mid-2022.

DATANFT.MARKET - we blocked the domain DataNFT.market and aim to replicate some of ALGA’s existing backend to create a Data NFT Marketplace with relevant information for each asset, including dataset consume volume, transaction volume, number of Datatoken holders and more.

Our Team

Data Whale Design Lead

Name: Luana Aires

Twitter: https://twitter.com/luanaairs

Billing: HOURS WORKED

ALGA Development Team

Name: Omar Saadoun, Juan Arrillaga, Axel Diaz & Raul (inMind Uruguay)

Billing: DEV HOURS WORKED (EXCL. TEAM LEAD)

Data Whale Ltd.

Name: Moritz Frings

Role: Project Lead / Director

OceanDAO Criteria

Criterion 1: Ocean Value-Add

- Usage: All our efforts and tools aim to make the engagement with the Ocean Market more intuitive.

- Viability: We have released the ALGA Datatoken Wallet successfully

- Community Active-ness: We are an integral part of the Ocean community and active across several channels. We have featured many articles and built an outreach program.

- Adding Value: Our primary objective is to add value to the general Ocean eco-system. Our content appeals to three audiences: data buyers, data publishers and data investors, both Web3 proficient and non-proficient.

Criterion 2: Ocean Protocol’s Mission & Values

- Evidently, we are aligned with Ocean Protocol’s Mission & Vision to unlock the value of data across all levels of society. Kindly visit our Blog for a deeper understanding of our views.

Criterion 3: Ocean Protocol’s Mission & Values

- We meet the minimum requirements of $OCEAN funds in our wallet linked above.

Data Whale Financials

Data Whale 2022 Targets

Actualized Network Revenue 2021: ~120’000 OCEAN

Estimated Network Revenue 2021: ~250’000 OCEAN

Total (est.) Network Revenue 2021: 370’000 OCEAN

Forecasted Actual Network Revenue 2022: ~140’000 OCEAN

Forecasted Estimated Network Revenue 2022: ~400’000 OCEAN

Total (est.) Network Revenue 2022: 540’000 OCEAN

For clarifications on above, please contact us

Conclusion

2022 will be a great year for the Ocean Protocol ecosystem. We thank you for your support.

Sincerely,